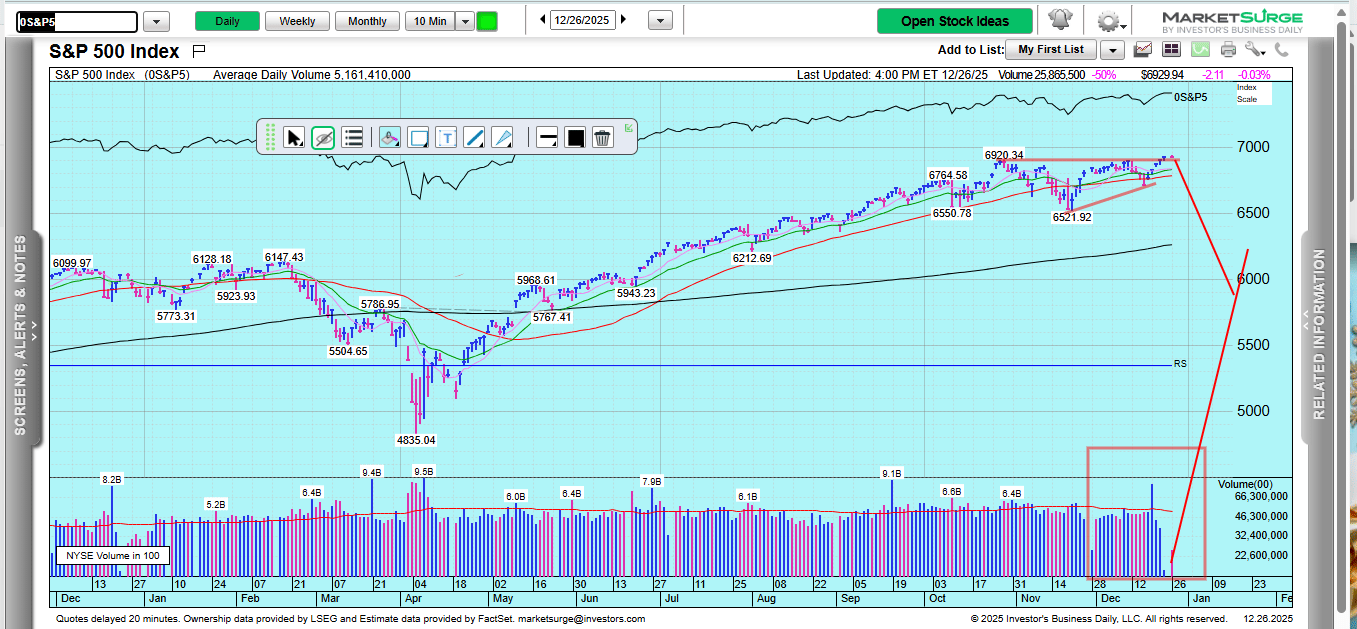

The index just experienced a dramatic selloff, dropping from around 24,019 to approximately 23,693 (down about 4% on the day shown). This sharp red candle broke decisively below a key trendline that had been supporting the market since late October. The volume spike accompanying this breakdown is significant—it shows this wasn't just noise, but a meaningful shift in market sentiment.

Here's where it gets interesting. The NASDAQ is now testing a critical support zone around the 23,500-23,700 level. This area previously acted as resistance in November before the breakout, and now it's the last line of defense before we revisit lower levels.

Two scenarios have high probability:

Bullish Case (40% probability): If the index can hold above 23,500 and reclaim the broken trendline around 23,800-24,000, we could see a relief rally back toward the 24,200-24,400 range. The selling may have been an overreaction or year-end tax-loss harvesting, and bargain hunters could step in aggressively.

Bearish Case (60% probability): If 23,500 fails to hold, we're likely looking at a move down to the next support around 23,100, with potential to test the psychological 23,000 level. The technical damage from breaking that ascending trendline is significant, and momentum has clearly shifted.

The volume pattern will be crucial—if we see declining volume on any further selloff, it suggests exhaustion. The relative strength indicator at the bottom appears oversold, which historically precedes bounces, but in strong downtrends, oversold conditions can persist.

Next week's action in the first few sessions will likely set the tone for January. A strong reversal Monday or Tuesday would be bullish; continued weakness would confirm the breakdown.

Marketsurge.com

S&P500

Marketsurge.com

The wait is over.

Tomorrow, I officially publish my Elliott Wave Trading Book.

A complete guide to advanced market structure.

Launch price: $40 only.